New Product Pricing & Market Feasibility Study

Before you reconfigure your factory, invest in new equipment or change work processes, it can be beneficial to conduct qualitative and quantitative market research to understand if your new product idea is feasible. This was the case for an automotive supplier that approached us late last year with a great idea for a new product.

The Challenge

Our client was an established player in the automotive industry, holding contracts with many of the nation’s top OEMs. They had an idea for a new automotive accessory that would utilize scrap material from another process and create value for their potential customers. It seemed like a win-win in terms of recycling and creating a new revenue source for the company.

However, while our client knew roughly how much the product would cost to manufacture, they were less clear on how feasible it would be to market and how to set pricing to move the volume of units they needed to make it worth it.

The Solution: A Two-Pronged Approach

1. Competitive Analysis

First, we conducted a competitive analysis of the 30 of the top-selling competitor’s products in our client’s anticipated marketplace (ecommerce). We started with qualitative discovery to identify the most important features, materials and design trends through product descriptions, images, videos, and verified customer reviews. Then we conducted qualitative research to determine pricing distribution among these products. Finally, we ran statistical analyses to determine what effect, if any, the presence of key features had on price.

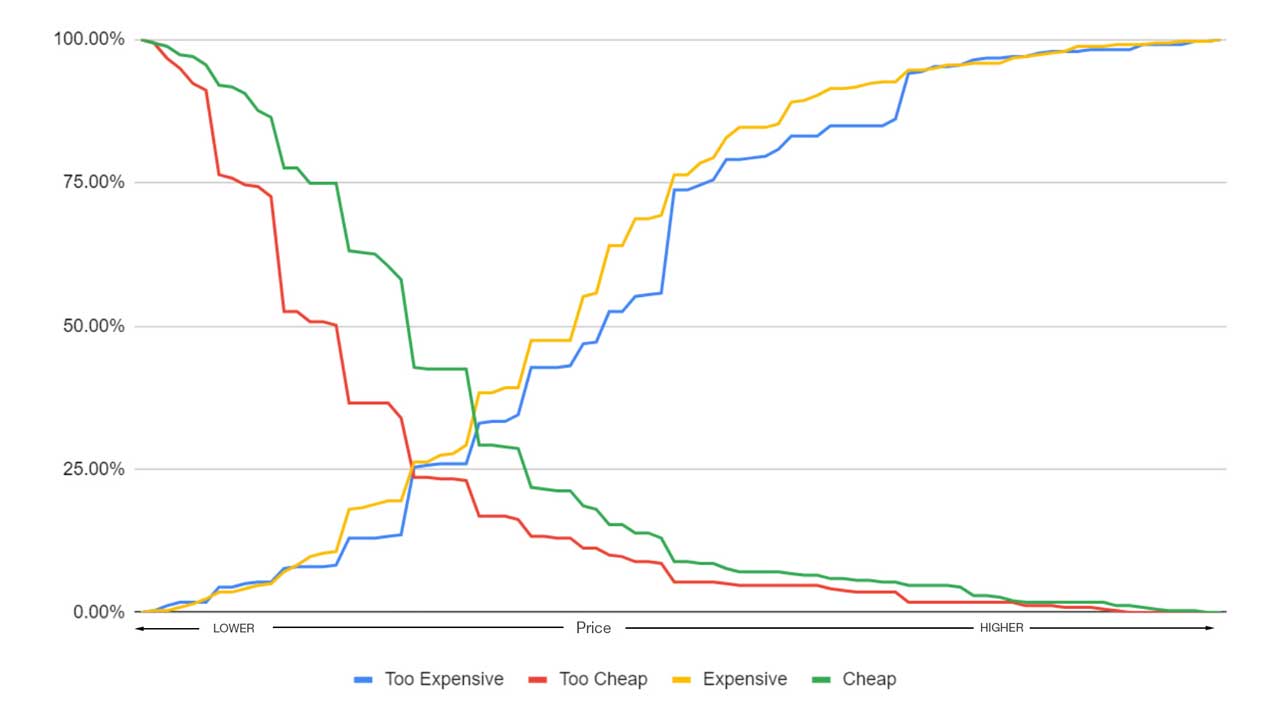

Graph of Van Westendorp Price-Sensitivity Results

2. Panel Research

In addition to our competitive analysis, we recruited a nationally representative panel of several hundred vehicle owners from around the United States.

Panelists responded to a series of questions based on the Van Westendorp price-sensitivity study, which allowed us to draw price perceptions directly from a diverse group of potential buyers.

Findings

Findings from our panel research and our competitive analysis showed strong consistency around what customers were willing to pay and the price, on average, competitors set for their products. Further, our qualitative research also created a solid understanding of the competitive landscape for our client’s product in the marketplace.

Unfortunately, the price our client needed to sell their product for to get a return on investment was much (nearly 3x) higher than what research indicated buyers would be willing to pay.

However, we laid out recommendations for several paths forward, which included options for:

- Refocusing sales on partnerships through OEMs instead of direct-to-customer;

- Looking at ways to improve efficiency and cut production costs to significantly lower price;

- Rebranding the product as a premium option (especially since our client’s design and materials were superior to that of their competitors).

Outcomes

Using our results and recommendations, our client was able to successfully take their new product to market with a unique strategy that combined several of our recommendations.

After launching a dedicated ecommerce website for this unique, premium product, they created several versions of the product, which let them appeal to more than one market segment. Versions included:

- A deluxe version, which through finding new efficiencies, they were able to price competitively among other high-end products.

- A standard version at a slightly lower price.

- And a simplified, smaller version of the product priced very competitively near the average cost of competitor’s products.

If you’re looking to take a new product to market, you don’t have to guess on pricing and feasibility.

Contact us by phone at (616) 786-4461 or send us an email to get started. We’d love to help you make your next product launch a smash success.